국내총생산(GDP)기준으로 마이너스 0.7%였다.

성장률은 경제 상황을 나타내주는 가장 중요한 기초자료다.

금리를 올릴 때에도 우선적으로 이 성장률부터 따지게 된다.

다음은 미국 상무부의 발표자료 전문.

이미지 확대보기

이미지 확대보기Gross Domestic Product: First Quarter 2015 (Second Estimate)

Corporate Profits: First Quarter 2015 (Preliminary Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- decreased at an annual rate of 0.7 percent in the first quarter of 2015, according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.2 percent.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, real GDP increased 0.2 percent. With the second estimate for the first quarter, imports increased more and private inventory investment increased less than previously estimated.

The decrease in real GDP in the first quarter primarily reflected negative contributions from exports, nonresidential fixed investment, and state and local government spending that were partly offset by positive contributions from personal consumption expenditures (PCE), private inventory investment, and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

The annual revision of the national income and product accounts will be released along with the "advance" estimate of GDP for the second quarter of 2015 on July 30. In addition to the regular revision of the estimates for the most recent 3 years and for the first quarter of 2015, some series will be revised back further. The June Survey of Current Business will contain an article that previews the annual revision, and the August Survey will contain an article that describes the results.

Real GDP decreased 0.7 percent in the first quarter of 2015, in contrast to an increase of 2.2 percent in the fourth quarter of 2014. The downturn in the percent change in real GDP primarily reflected a deceleration in PCE and downturns in exports, in nonresidential fixed investment, and in state and local government spending that were partly offset by a deceleration in imports and upturns in federal government spending and in private inventory investment.

The price index for gross domestic purchases, which measures prices paid by U.S. residents, decreased 1.6 percent in the first quarter, a downward revision of 0.1 percentage point from the advance estimate; this index decreased 0.1 percent in the fourth quarter. Excluding food and energy prices, the price index for gross domestic purchases increased 0.2 percent, compared with an increase of 0.7

percent.

Real personal consumption expenditures increased 1.8 percent in the first quarter, compared with an increase of 4.4 percent in the fourth. Durable goods increased 1.1 percent, compared with an increase of 6.2 percent. Nondurable goods increased 0.1 percent, compared with an increase of 4.1 percent. Services increased 2.5 percent, compared with an increase of 4.3 percent.

Real nonresidential fixed investment decreased 2.8 percent in the first quarter, in contrast to an increase of 4.7 percent in the fourth. Investment in nonresidential structures decreased 20.8 percent, in contrast to an increase of 5.9 percent. Investment in equipment increased 2.7 percent, compared with an increase of 0.6 percent. Investment in intellectual property products increased 3.6 percent, compared

with an increase of 10.3 percent. Real residential fixed investment increased 5.0 percent, compared with an increase of 3.8 percent.

Real exports of goods and services decreased 7.6 percent in the first quarter, in contrast to an increase of 4.5 percent in the fourth. Real imports of goods and services increased 5.6 percent, compared with an increase of 10.4 percent.

Real federal government consumption expenditures and gross investment increased 0.1 percent in the first quarter, in contrast to a decrease of 7.3 percent in the fourth. National defense decreased 1.0 percent, compared with a decrease of 12.2 percent. Nondefense increased 2.0 percent, compared with an increase of 1.5 percent. Real state and local government consumption expenditures and gross

investment decreased 1.8 percent, in contrast to an increase of 1.6 percent.

The change in real private inventories added 0.33 percentage point to the first-quarter change in real GDP after subtracting 0.10 percentage point from the fourth-quarter change. Private businesses increased inventories $95.0 billion in the first quarter, following increases of $80.0 billion in the fourth quarter and $82.2 billion in the third. Real final sales of domestic product -- GDP less change in private inventories -- decreased 1.1 percent in the first quarter, in contrast to an increase of 2.3 percent in the fourth.

Gross domestic purchases

Real gross domestic purchases -- purchases by U.S. residents of goods and services wherever produced -- increased 1.1 percent in the first quarter, compared with an increase of 3.2 percent in the fourth.

Gross national product

Real gross national product -- the goods and services produced by the labor and property supplied by U.S. residents -- decreased 1.4 percent in the first quarter, in contrast to an increase of 1.4 percent in the fourth. GNP includes, and GDP excludes, net receipts of income from the rest of the world, which decreased $24.9 billion in the first quarter, compared with a decrease of $30.7 billion in

the fourth; in the first quarter, receipts decreased $22.4 billion, and payments increased $2.5 billion.

Current-dollar GDP

Current-dollar GDP -- the market value of the production of goods and services in the United States -- decreased 0.9 percent, or $38.7 billion, in the first quarter to a level of $17,665.0 billion. In the fourth quarter, current-dollar GDP increased 2.4 percent, or $103.9 billion.

Gross domestic income

Real gross domestic income (GDI), which measures the value of the production of goods and services in the United States as the costs incurred and the incomes earned in production, increased 1.4 percent in the first quarter, compared with an increase of 3.7 percent (revised) in the fourth. For a given quarter, the estimates of GDP and GDI may differ for a variety of reasons, including the incorporation of

largely independent source data. However, over longer time spans, the estimates of GDP and GDI tend to follow similar patterns of change.

Revisions

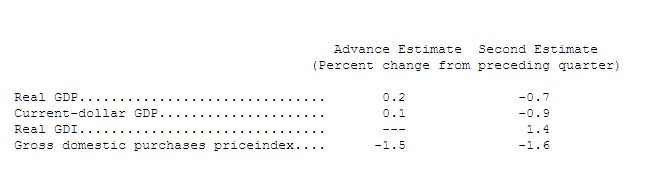

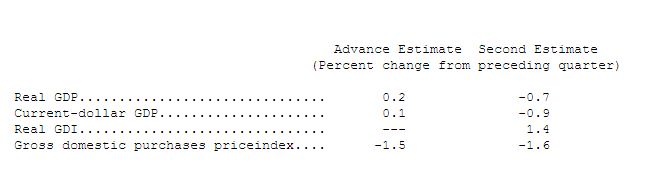

The second estimate of the first-quarter percent change in real GDP is 0.9 percentage point, or $40.7 billion, less than the advance estimate issued last month, primarily reflecting an upward revision to imports and downward revisions to private inventory investment and to personal consumption expenditures that were partly offset by an upward revision to residential fixed investment.

Advance Estimate Second Estimate

(Percent change from preceding quarter)

Real GDP............................... 0.2 -0.7

Current-dollar GDP..................... 0.1 -0.9

Real GDI............................... --- 1.4

Gross domestic purchases priceindex.... -1.5 -1.6

Corporate Profits

Profits from current production

Profits from current production (corporate profits with inventory valuation adjustment (IVA) and capital consumption adjustment (CCAdj)) decreased $125.5 billion in the first quarter, compared with a decrease of $30.4 billion in the fourth.

Profits of domestic financial corporations decreased $2.6 billion in the first quarter, compared with a decrease of $12.5 billion in the fourth. Profits of domestic nonfinancial corporations decreased $100.4 billion, in contrast to an increase of $18.1 billion. The rest-of-the-world component of profits decreased $22.4 billion, compared with a decrease of $36.1 billion. This measure is calculated as the

difference between receipts from the rest of the world and payments to the rest of the world. In the first quarter, receipts decreased $28.9 billion, and payments decreased $6.5 billion.

Taxes on corporate income increased $9.3 billion in the first quarter, in contrast to a decrease of $4.8 billion in the fourth. Profits after tax with IVA and CCA decreased $134.6 billion, compared with a decrease of $25.8 billion. The first-quarter changes in taxes on corporate income mainly reflect the expiration of bonus depreciation provisions.

Dividends increased $5.1 billion in the first quarter, compared with an increase of $18.6 billion in the fourth. Undistributed profits decreased $139.7 billion, compared with a decrease of $44.3 billion. Net cash flow with IVA -- the internal funds available to corporations for investment -- decreased $132.1 billion, in contrast to an increase of $12.2 billion.

The IVA and CCA are adjustments that convert inventory withdrawals and depreciation of fixed assets reported on a tax-return, historical-cost basis to the current-cost economic measures used in the national income and product accounts. The IVA increased $29.4 billion, compared with an increase of $27.5 billion. The CCA decreased $220.4 billion, in contrast to an increase of $3.9 billion. The

first-quarter changes in CCA mainly reflect the expiration of bonus depreciation provisions.

김재희 기자 tiger8280@

![[뉴욕증시] 3대 지수 반등...나스닥, 사상 최고](https://nimage.g-enews.com/phpwas/restmb_setimgmake.php?w=270&h=173&m=1&simg=2025071505213601314be84d87674118221120199.jpg)