이미지 확대보기

이미지 확대보기제롬 파월 미국 연준 의장의 테이퍼링 구상이 발표됐다. 제롬 파월 미국 연방준비제도 이사회(Fed) 의장은 잭슨홀 연설에서 올해 중 테이퍼링 즉 자산매입 축소 시작을 공식화했다. 많은 전문가들은 파월의장이 잭슨홀 심포지움 연설에서 테이퍼링이라는 말을 아예 언급조차 하지 않을 것이라고 전망했었다. 제롬파월은 이 같은 뉴욕증시 일각의 전망을 정면으로 뒤집으면서 잭슨홀 미팅 연설에서 테이퍼링을 여러 차례 언급했다. 그것도 연내 테이퍼링이라면서 테이퍼링의 시점까지도 못 박았다. 뉴욕증시로서는 예상하지 못했던 의외의 일격을 당한 셈이다.

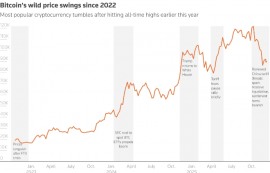

그럼에도 불구하고 뉴욕증시는 폭락하지 않았다. 아니 오히려 크게 올랐다. 28일 새벽에 끝난 뉴욕증권거래소(NYSE)에 따르면 다우존스30산업평균지수는 242.68포인트(0.69%) 오른 35,455.80으로 마감했다. 스탠더드앤드푸어스(S&P)500지수는 39.37포인트(0.88%) 상승한 4,509.37로 끝났다. 기술주의 나스닥지수는 183.69포인트(1.23%) 오른 15,129.50으로 마쳤다. S&P500지수는 사상 처음 4,500을 넘어서면서 마감했다. 나스닥지수도 사상 최고치를 또 경신했다. 미국 뉴욕증시 나스닥 다우지수 뿐 아니라 국제유가 달러환율 코스피 코스닥 그리고 비트코인 도지코인 이더리움등 가상화폐에도 청신호가 켜졌다.

왜 이 같은 이변이 일어난 것일까? 그 해답은 제롬파월의 잭슨홀 미팅 연설문을 자세히 뜯어보면 가늠할 수 있다. 제롬파월의 잭슨홀 미팅 연설은 겉으로는 테이퍼링 연내 시행 처럼 보이지만 그 속에는 유보의 가능성이 열려있다. 향후 경제 지표와 신종 코로나바이러스 감염증(코로나19) 상황을 지켜보겠다며 여지를 열어두고 있는 것이다. 여차하면 테이퍼링을 더 늦출 수 있다고 언급한 대목이 뉴욕증시에 훈풍을 몰고 왔다. 테이퍼링과 무관하게 제로금리를 당분간 그대로 유지하겠다는 의사를 확인한 것도 뉴욕증시의 '랠리'로 이어졌다. 파월은 테이퍼링 시작이 곧 기준금리 인상의 '신호탄'이 되는 것은 아니라며 금리 인상까지는 갈 길이 멀다고 못 박았다.

파월의장은 특히 연준이 월 1200억달러 상당의 미 국채와 주택저당증권(MBS) 매입 규모를 줄여나가는 테이퍼링에 착수하더라도 이를 기준금리 인상의 신호로 해석해서는 안 된다고 강조했다. "향후 자산매입 감축의 시기와 속도가 금리 인상 시기에 관한 직접적인 시그널을 전달하는 것은 아니다"라는 것이다. 기준 금리 인상에 대해선 테이퍼링과 다르고 더 엄격한 기준을 적용하겠다는 뜻도 밝혔다.

파월 의장은 인플레이션 폭발 우려에도 "일시적 일 수 있다"는 점을 환기시켰다. 미국 연준은 그동안 장기 평균 2%의 물가상승률과 최대 고용의 목표를 달성할 때까지 현재의 '제로 금리'를 유지하겠다는 입장을 밝혀왔다. 파월은 그 중 고용과 관련해 " 목표에 도달하기까지 갈 길이 한참 남았다"고 밝혔다. 또 인플레이션 우려에 대해선 "지속적인 관점에서 물가상승률이 2%에 도달한 것인지 아닌지는 시간이 말해줄 것"이라고 밝혔다. 현재의 높은 물가상승률은 "대부분 코로나19 대유행과 경제 재개의 직접 영향을 받은 (중고차 등) 몇몇 상품과 서비스 때문"이라면서 "대유행이 끝나면 인플레이션 완화 압력이 다시 강해질 것"이라고 진단했다. 파월 의장의 이 같은 언급은 '일시적 현상'일 가능성이 큰 인플레이션 때문에 섣불리 금리를 올렸다가 고용을 포함한 경제 전반의 회복에 차질이 빚어질 것을 우려해 비둘기적 메시지를 전달하려는 의도로 해석된다.

파월의장은 뉴욕증시가 가장 주목하던 테이퍼링과 관련해 "경제가 기대만큼 광범위하게 발전한다면 올해 안에 자산매입 속도를 줄이기 시작하는 게 적절할 수 있다"는 견해를 피력했다. 연설 직전 발표된 7월 근원 개인소비지출(PCE) 가격지수가 30년 만의 최대폭인 3.6% 오르는 등 각종 물가지표가 목표치인 2%를 크게 넘어서고 집값도 급등하면서 테이퍼링을 서둘러야 한다는 주장이 이어졌다. 로버트 캐플런 댈러스 연방준비은행 총재, 래피얼 보스틱 애틀랜타 연은 총재, 패트릭 하커 필라델피아 연은 총재, 로레타 메스터 클리블랜드 연은 총재 등이 조기 테이퍼링 착수를 공개 요구했다.

파월 의장은 연내 테이퍼링 시작을 요구하는 이 같은 요구에 원론적으로 동의했다. 그러면서도 구체적인 로드맵과 일정표까지는 제시하지 않았다. 파월 의장은 또 테이퍼링에 앞서 고용과 델타 변이의 추이를 더 지켜보겠다는 '단서'도 달았다. 월스트리트저널(WSJ)은 이에 대해 연준이 이르면 9월 연방공개시장위원회(FOMC) 정례회의에서 테이퍼링 계획을 내놓을 가능성이 있지만, 11월 전까지는 실행에 들어가기 어려울 것으로 내다봤다. 델타 변이가 경제 그중에서도 특히 고용 회복에 지장을 초래할 경우 테이퍼링 스케줄이 더 밀릴 수도 있다고 내다봤다.

파월 의장은 또 테이퍼링이 기준금리 인상의 직접적인 신호는 아니라면서 금리 인상의 전제 조건 중 '최대 고용' 목표 달성까지 "갈 길이 멀다"고 진단했다. 미국의 일자리 수는 코로나19 사태 직전보다 600만개 모자란 상태로, 현재 실업률 5.4%도 지난해 2월 3.5%보다 훨씬 높다. 과열 양상인 물가상승률 역시 머지않아 사라질 '일시적 현상'이라는 기존 판단을 유지했다. 이처럼 조심스러운 파월 의장의 연설에 '긴축 발작'(Taper Tantrum)은 나타나지 않았다. 2013년 잭슨홀 미팅에서는 벤 버냉키 당시 연준 의장의 테이퍼링 예고 연설을 한후 달러화와 국채 금리, 신흥국 주가 등이 폭락한 바 있다. 그러나 이번 제롬파월의 잭슨홀 미팅 연설 이후에는 긴축발작은 커녕 뉴욕증시가 오히려 폭등세를 보였다. 시카고상품거래소(CME) 페드워치에 따르면 연방기금(FF) 금리 선물 시장은 내년 3월 25bp 기준금리 인상 가능성을 5.0%로 나타났다. 내년 12월 금리 인상 가능성은 39%로 전날의 41.1%에서 하락했다. 2022년 2월까지 두 차례 금리가 인상될 가능성은 하루 전 19.7%에서 16.4%로, 세 차례 금리 인상 가능성은 하루 전의 4.5%에서 3.3%로 각각 하락했다. 미국 시카고옵션거래소(CBOE)에서 변동성 지수(VIX)는 전장보다 2.45포인트(13.00%) 하락한 16.39를 기록했다.

연준이 최근 공개한 지난달 FOMC 의사록에 따르면 '일부' 위원들은 내년초까지 기다리자고 주장했지만 "대부분 참석자들이 미 경제가 기대했던 것과 같은 개선 흐름을 보임에 따라 올해 자산 매입 속도를 줄이기 시작하는 것이 적절할 수 있다는 판단을 내렸다."고 되어있다. 파월은 이번 잭슨홀 연설에서 자신도 연내 테이퍼링을 예상하는 이 '대부분 참석자' 가운데 한 명이었음을 밝혔다. 당시 제롬파월은 FOMC 회의 뒤 미국 경제가 "7월 탄탄한 고용 보고서라는 형태의 추가 개선을 이뤘다"고 평가하면서도 "신종 코로나바이러스 감염증(코로나19) 델타변이 확산세가 변수"라는 점을 강조했다. "델타변이 추가 확산 역시 이어지고 있다"고 우려하기도 해다. 그 시각을 이번 잭슨홀 미팅에서 좀 더 강화한 것으로 보인다.

미국 상무부 7월 소비지출 통계도 델타변이 확산 여파가 나타나고 있다. 상무부에 따르면 지난달 미 소비자들의 지출 규모는 증가율이 0.3%로 뚝 떨어졌다. 6월 소비지출 증가율 1.1%의 3분의1에도 못미친다. 서비스 지출은 늘었지만 재화 지출은 오히려 줄었다. 델타변이 확산이 미 경제에 먹구름을 드리우고 있음을 시사한다. 파월은 이런 점들은 언급하면서 11월 2~3일 FOMC 이전에 테이퍼링이 시작되지는 않을 것임을 강력하게 시사했다. 미국 뉴욕증시 나스닥 다우지수 뿐 아니라 국제유가 달러환율 코스피 코스닥 그리고 비트코인 도지코인 이더리움등 가상화폐로서도 랠리의 기회를 맞은 셈이다. .

지난 주말 코스피가 한국은행의 금리 인상에도 소폭 상승 마감했다. 코스피는 5.37포인트(0.17%) 상승한 3,133.90에 마쳤다. 서울 외환시장에서 원/달러 환율은 1.3원 내린 달러당 1,169.2원에 마쳤다. 아시아 증시는 혼조 마감했다. 일본 닛케이지수는 0.36%, 홍콩 항셍지수는 0.14% 하락했다. 중국 상하이종합지수와 대만 자취안지수도 0.84% 상승했다. 셀트리온[068270](3.51%)과 카카오[035720](0.33%), 카카오뱅크[323410](0.48%), 크래프톤[259960](5.86%) 등이 상승했다. 삼성전자[005930](-0.40%)와 SK하이닉스[000660](-0.83%), 네이버[035420](-0.83%) 등은 내렸다. 엔씨소프트[036570](-7.05%)는 급락했다. 셀트리온헬스케어[091990](1.23%), 에코프로비엠[247540](0.19%), 셀트리온제약[068760](1.30%) 등은 올랐다. 펄어비스[263750](1.25%)도 상승했다. 카카오게임즈[293490](-5.27%), SK머티리얼즈[036490](-0.42%), 엘앤에프(-1.07%) 등은 하락했다.

이미지 확대보기

이미지 확대보기제롬파월 잭슨홀미팅 연설 전문

Seventeen months have passed since the U.S. economy faced the full force of the COVID-19 pandemic. This shock led to an immediate and unprecedented decline as large parts of the economy were shuttered to contain the spread of the disease.

The path of recovery has been a difficult one, and a good place to begin is by thanking those on the front line fighting the pandemic: the essential workers who kept the economy going, those who have cared for others in need, and those in medical research, business, and government, who came together to discover, produce, and widely distribute effective vaccines in record time. We should also keep in our thoughts those who have lost their lives from COVID, as well as their loved ones.

Strong policy support has fueled a vigorous but uneven recovery—one that is, in many respects, historically anomalous. In a reversal of typical patterns in a downturn, aggregate personal income rose rather than fell, and households massively shifted their spending from services to manufactured goods. Booming demand for goods and the strength and speed of the reopening have led to shortages and bottlenecks, leaving the COVID-constrained supply side unable to keep up. The result has been elevated inflation in durable goods—a sector that has experienced an annual inflation rate well below zero over the past quarter century.1 Labor market conditions are improving but turbulent, and the pandemic continues to threaten not only health and life, but also economic activity. Many other advanced economies are experiencing similarly unusual conditions.

In my comments today, I will focus on the Fed's efforts to promote our maximum employment and price stability goals amid this upheaval, and suggest how lessons from history and a careful focus on incoming data and the evolving risks offer useful guidance for today's unique monetary policy challenges.

The Recession and Recovery So Far

The pandemic recession—the briefest yet deepest on record—displaced roughly 30 million workers in the space of two months.2 The decline in output in the second quarter of 2020 was twice the full decline during the Great Recession of 2007–09.3 But the pace of the recovery has exceeded expectations, with output surpassing its previous peak after only four quarters, less than half the time required following the Great Recession. As is typically the case, the recovery in employment has lagged that in output; nonetheless, employment gains have also come faster than expected.4

The economic downturn has not fallen equally on all Americans, and those least able to shoulder the burden have been hardest hit. In particular, despite progress, joblessness continues to fall disproportionately on lower-wage workers in the service sector and on African Americans and Hispanics.

The unevenness of the recovery can further be seen through the lens of the sectoral shift of spending into goods—particularly durable goods such as appliances, furniture, and cars—and away from services, particularly in-person services in areas such as travel and leisure (figure 1). As the pandemic struck, restaurant meals fell 45 percent, air travel 95 percent, and dentist visits 65 percent. Even today, with overall gross domestic product and consumption spending more than fully recovered, services spending remains about 7 percent below trend. Total employment is now 6 million below its February 2020 level, and 5 million of that shortfall is in the still-depressed service sector. In contrast, spending on durable goods has boomed since the start of the recovery and is now running about 20 percent above the pre-pandemic level. With demand outstripping pandemic-afflicted supply, rising durables prices are a principal factor lifting inflation well above our 2 percent objective.

Given the ongoing upheaval in the economy, some strains and surprises are inevitable. The job of monetary policy is to promote maximum employment and price stability as the economy works through this challenging period. I will turn now to a discussion of progress toward those goals.

The Path Ahead: Maximum Employment

The outlook for the labor market has brightened considerably in recent months. After faltering last winter, job gains have risen steadily over the course of this year and now average 832,000 over the past three months, of which almost 800,000 have been in services (figure 2). The pace of total hiring is faster than at any time in the recorded data before the pandemic. The levels of job openings and quits are at record highs, and employers report that they cannot fill jobs fast enough to meet returning demand.

These favorable conditions for job seekers should help the economy cover the considerable remaining ground to reach maximum employment. The unemployment rate has declined to 5.4 percent, a post-pandemic low, but is still much too high, and the reported rate understates the amount of labor market slack.5 Long-term unemployment remains elevated, and the recovery in labor force participation has lagged well behind the rest of the labor market, as it has in past recoveries.

With vaccinations rising, schools reopening, and enhanced unemployment benefits ending, some factors that may be holding back job seekers are likely fading.6 While the Delta variant presents a near-term risk, the prospects are good for continued progress toward maximum employment.

The Path Ahead: Inflation

The rapid reopening of the economy has brought a sharp run-up in inflation. Over the 12 months through July, measures of headline and core personal consumption expenditures inflation have run at 4.2 percent and 3.6 percent, respectively—well above our 2 percent longer-run objective.7 Businesses and consumers widely report upward pressure on prices and wages. Inflation at these levels is, of course, a cause for concern. But that concern is tempered by a number of factors that suggest that these elevated readings are likely to prove temporary. This assessment is a critical and ongoing one, and we are carefully monitoring incoming data.

The dynamics of inflation are complex, and we assess the inflation outlook from a number of different perspectives, as I will now discuss.

1. The absence so far of broad-based inflation pressures

The spike in inflation is so far largely the product of a relatively narrow group of goods and services that have been directly affected by the pandemic and the reopening of the economy. Durable goods alone contributed about 1 percentage point to the latest 12‑month measures of headline and core inflation. Energy prices, which rebounded with the strong recovery, added another 0.8 percentage point to headline inflation, and from long experience we expect the inflation effects of these increases to be transitory. In addition, some prices—for example, for hotel rooms and airplane tickets—declined sharply during the recession and have now moved back up close to pre-pandemic levels. The 12-month window we use in computing inflation now captures the rebound in prices but not the initial decline, temporarily elevating reported inflation. These effects, which are adding a few tenths to measured inflation, should wash out over time.

We consult a range of measures meant to capture whether price increases for particular items are spilling over into broad-based inflation. These include trimmed mean measures and measures excluding durables and computed from just before the pandemic. These measures generally show inflation at or close to our 2 percent longer-run objective (figure 3). We would be concerned at signs that inflationary pressures were spreading more broadly through the economy.

2. Moderating inflation in higher-inflation items

We are also directly monitoring the prices of particular goods and services most affected by the pandemic and the reopening, and are beginning to see a moderation in some cases as shortages ease. Used car prices, for example, appear to have stabilized; indeed, some price indicators are beginning to fall. If that continues, as many analysts predict, then used car prices will soon be pulling measured inflation down, as they did for much of the past decade.8

This same dynamic of upward inflation pressure dissipating and, in some cases, reversing seems likely to play out in durables more generally. Over the 25 years preceding the pandemic, durables prices actually declined, with inflation averaging negative 1.9 percent per year (figure 5).9 As supply problems have begun to resolve, inflation in durable goods other than autos has now slowed and may be starting to fall. It seems unlikely that durables inflation will continue to contribute importantly over time to overall inflation. We will be looking for evidence that supports or undercuts that expectation.

3. Wages

We also assess whether wage increases are consistent with 2 percent inflation over time. Wage increases are essential to support a rising standard of living and are generally, of course, a welcome development. But if wage increases were to move materially and persistently above the levels of productivity gains and inflation, businesses would likely pass those increases on to customers, a process that could become the sort of "wage–price spiral" seen at times in the past.10 Today we see little evidence of wage increases that might threaten excessive inflation (figure 6). Broad-based measures of wages that adjust for compositional changes in the labor force, such as the employment cost index and the Atlanta Wage Growth Tracker, show wages moving up at a pace that appears consistent with our longer-term inflation objective. We will continue to monitor this carefully.

4. Longer-term inflation expectations

Policymakers and analysts generally believe that, as long as longer-term inflation expectations remain anchored, policy can and should look through temporary swings in inflation. Our monetary policy framework emphasizes that anchoring longer-term expectations at 2 percent is important for both maximum employment and price stability.

We carefully monitor a wide range of indicators of longer-term inflation expectations. These measures today are at levels broadly consistent with our 2 percent objective (figure 4). Because measures of inflation expectations are individually noisy, we also focus on common patterns across the measures. One approach to summarizing these patterns is the Board staff's index of common inflation expectations (CIE), which combines information from a broad range of survey and market-based measures.11 This index captures a general move down in expectations starting around 2014, a time when inflation was running persistently below 2 percent. More recently, the index shows a welcome reversal of that decline and is now at levels more consistent with our 2 percent objective.

Longer-term inflation expectations have moved much less than actual inflation or near-term expectations, suggesting that households, businesses, and market participants also believe that current high inflation readings are likely to prove transitory and that, in any case, the Fed will keep inflation close to our 2 percent objective over time.12

5. The prevalence of global disinflationary forces over the past quarter century

Finally, it is worth noting that, since the 1990s, inflation in many advanced economies has run somewhat below 2 percent even in good times (figure 7). The pattern of low inflation likely reflects sustained disinflationary forces, including technology, globalization and perhaps demographic factors, as well as a stronger and more successful commitment by central banks to maintain price stability.13 In the United States, unemployment ran below 4 percent for about two years before the pandemic, while inflation ran at or below 2 percent. Wages did move up across the income spectrum—a welcome development—but not by enough to lift price inflation consistently to 2 percent. While the underlying global disinflationary factors are likely to evolve over time, there is little reason to think that they have suddenly reversed or abated. It seems more likely that they will continue to weigh on inflation as the pandemic passes into history.14

We will continue to monitor incoming inflation data against each of these assessments.

To sum up, the baseline outlook is for continued progress toward maximum employment, with inflation returning to levels consistent with our goal of inflation averaging 2 percent over time. Let me now turn to how the baseline outlook and the associated risks and uncertainties figure in our monetary policymaking.

Implications for Monetary Policy

The period from 1950 through the early 1980s provides two important lessons for managing the risks and uncertainties we face today. The early days of stabilization policy in the 1950s taught monetary policymakers not to attempt to offset what are likely to be temporary fluctuations in inflation.15 Indeed, responding may do more harm than good, particularly in an era where policy rates are much closer to the effective lower bound even in good times. The main influence of monetary policy on inflation can come after a lag of a year or more. If a central bank tightens policy in response to factors that turn out to be temporary, the main policy effects are likely to arrive after the need has passed. The ill-timed policy move unnecessarily slows hiring and other economic activity and pushes inflation lower than desired. Today, with substantial slack remaining in the labor market and the pandemic continuing, such a mistake could be particularly harmful. We know that extended periods of unemployment can mean lasting harm to workers and to the productive capacity of the economy.16

History also teaches, however, that central banks cannot take for granted that inflation due to transitory factors will fade. The 1970s saw two periods in which there were large increases in energy and food prices, raising headline inflation for a time. But when the direct effects on headline inflation eased, core inflation continued to run persistently higher than before. One likely contributing factor was that the public had come to generally expect higher inflation—one reason why we now monitor inflation expectations so carefully.17

Central banks have always faced the problem of distinguishing transitory inflation spikes from more troublesome developments, and it is sometimes difficult to do so with confidence in real time. At such times, there is no substitute for a careful focus on incoming data and evolving risks. If sustained higher inflation were to become a serious concern, the Federal Open Market Committee (FOMC) would certainly respond and use our tools to assure that inflation runs at levels that are consistent with our goal.

Incoming data should provide more evidence that some of the supply–demand imbalances are improving, and more evidence of a continued moderation in inflation, particularly in goods and services prices that have been most affected by the pandemic. We also expect to see continued strong job creation. And we will be learning more about the Delta variant's effects. For now, I believe that policy is well positioned; as always, we are prepared to adjust policy as appropriate to achieve our goals.

That brings me to a concluding word on the path ahead for monetary policy. The Committee remains steadfast in our oft-expressed commitment to support the economy for as long as is needed to achieve a full recovery. The changes we made last year to our Statement on Longer-Run Goals and Monetary Policy Strategy are well suited to address today's challenges.

We have said that we would continue our asset purchases at the current pace until we see substantial further progress toward our maximum employment and price stability goals, measured since last December, when we first articulated this guidance. My view is that the "substantial further progress" test has been met for inflation. There has also been clear progress toward maximum employment. At the FOMC's recent July meeting, I was of the view, as were most participants, that if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year. The intervening month has brought more progress in the form of a strong employment report for July, but also the further spread of the Delta variant. We will be carefully assessing incoming data and the evolving risks. Even after our asset purchases end, our elevated holdings of longer-term securities will continue to support accommodative financial conditions.

The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test. We have said that we will continue to hold the target range for the federal funds rate at its current level until the economy reaches conditions consistent with maximum employment, and inflation has reached 2 percent and is on track to moderately exceed 2 percent for some time. We have much ground to cover to reach maximum employment, and time will tell whether we have reached 2 percent inflation on a sustainable basis.

These are challenging times for the public we serve, as the pandemic and its unprecedented toll on health and economic activity linger. But I will end on a positive note. Before the pandemic, we all saw the extraordinary benefits that a strong labor market can deliver to our society. Despite today's challenges, the economy is on a path to just such a labor market, with high levels of employment and participation, broadly shared wage gains, and inflation running close to our price stability goal. Thank you very much.

References

Bodenstein, Martin, Christopher J. Erceg, and Luca Guerrieri (2008). "Optimal Monetary Policy with Distinct Core and Headline Inflation Rates," Journal of Monetary Economics, vol. 55, supplement (October), pp. S18–S33.

Bordo, Michael D., and Athanasios Orphanides, eds. (2013). The Great Inflation: The Rebirth of Modern Central Banking. Chicago: University of Chicago Press.

Canon, Maria E., Marianna Kudlyak, and Marisa Reed (2015). "Aging and the Economy: The Japanese Experience," Federal Reserve Bank of St. Louis, Regional Economist, vol. 23 (October), pp. 12–13.

Davis, Steven J., and Till von Wachter (2011). "Recessions and the Costs of Job Loss (PDF)," Brookings Papers on Economic Activity, Fall, pp. 1–72.

Forbes, Kristin J. (2019). "Inflation Dynamics: Dead, Dormant, or Determined Abroad? (PDF)" Brookings Papers on Economic Activity, Fall, pp. 257–319.

Friedman, Milton (1958). "The Supply of Money and Changes in Prices and Output," in The Relationship of Prices to Economic Stability and Growth: Compendium of Papers Submitted by Panelists Appearing before the Joint Economic Committee, Joint Committee Print, March 31, 85 Cong. Washington: Government Printing Office, pp. 241–56.

Goodhart, Charles, and Manoj Pradhan (2020). The Great Demographic Reversal: Ageing Societies, Waning Inequality, and an Inflation Revival. Cham, Switzerland: Palgrave Macmillan.

Mishkin, Frederic S. (2007). "Headline versus Core Inflation in the Conduct of Monetary Policy," speech delivered at the Business Cycles, International Transmission and Macroeconomic Policies Conference, HEC Montreal, Montreal, October 20.

Obstfeld, Maurice (2020). "Global Dimensions of U.S. Monetary Policy," International Journal of Central Banking, vol. 16 (February), pp. 73–132.

Orphanides, Athanasios, and John C. Williams (2013). "Monetary Policy Mistakes and the Evolution of Inflation Expectations," in Michael D. Bordo and Athanasios Orphanides, eds., The Great Inflation: The Rebirth of Modern Central Banking. Chicago: University of Chicago Press, pp. 255–88.

Powell, Jerome H. (2019). "Challenges for Monetary Policy," speech delivered at "Challenges for Monetary Policy," a symposium sponsored by the Federal Reserve Bank of Kansas City, held in Jackson Hole, Wyo., August 23.

김대호 글로벌이코노믹 연구소장 tiger8280@g-enews.com