이미지 확대보기

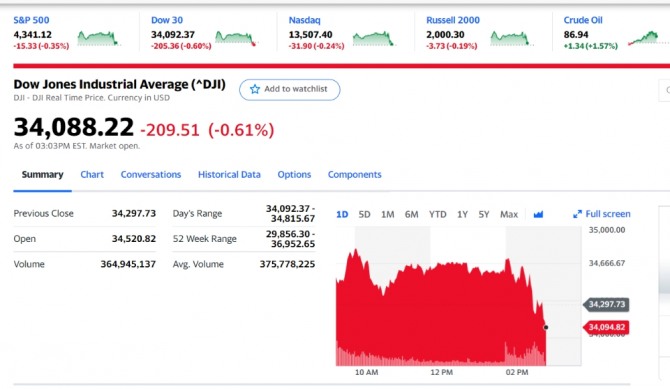

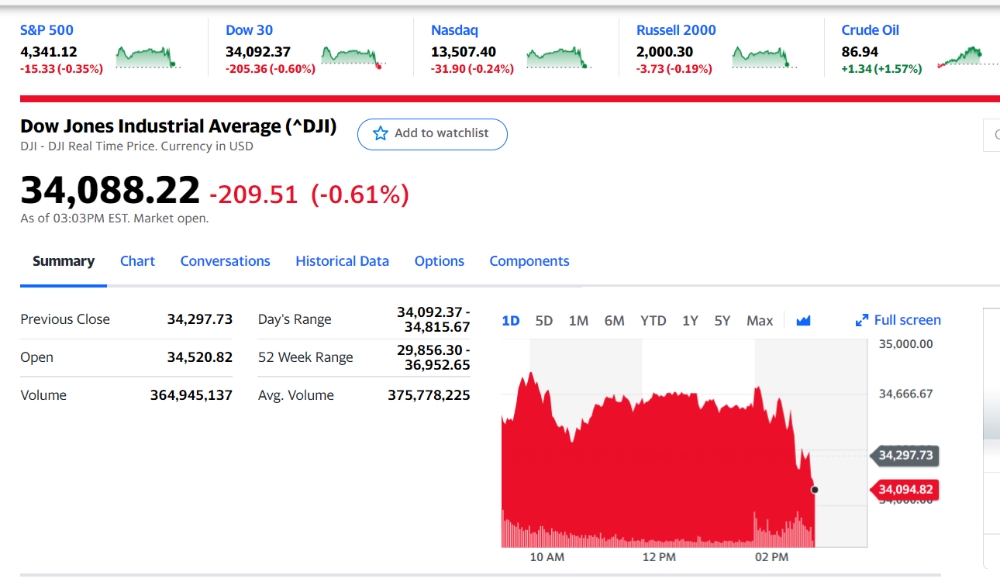

이미지 확대보기27일 뉴욕증시에 따르면 FOMC 정책성명서 발표 때 상승세를 보이던 나스닥 다우지수 등이 갑자기 하락 반전하고 있다. 제롬파월 연준의장이 기자회견에서 테이퍼링 종료를 2월로 앞 당기겠다고 밝히면서 대차대조표 양적 축소 가능성까지 언급하는 등 매파적 정책을 시사하면서 뉴욕증시가 하락 반전하고 있다.

연준 FOMC 성명에서 연준은 금리 인상이 "곧 적절해질 것"이라고만 밝혔다. 뉴욕증시에서는 금리인상의 시점을 이르면 3월로 보고 있다. 파월 의장은 회견에서 "우리는 3월 (FOMC) 회의에서 금리를 올릴지 말지 결정할 것"이라면서 "조건이 무르익는다고 가정한다면 3월에 금리를 올릴 수 있다"고 밝혔다.

앞서 미국 중앙은행인 연방준비제도(Fed·연준)는 조만간 금리를 인상하는 것이 적절하다는 정책 성명서를 냈다. 현재로서는 금리를 현행처럼 동결하지만 이르면 3월 금리 인상을 시사한 것이다.

연준은 이틀간의 연방공개시장위원회(FOMC) 정례회의를 마친 뒤 낸 성명에서 미 연방 금리를 현 수준으로 유지하지만, 고용상황 개선과 지속적인 인플레이션을 감안해 조만간 금리를 인상하겠다는 방침을 밝혔다. 연준 정책성명서에는"인플레이션이 2%를 웃돌고 강력한 노동 시장 탓에 금리의 목표 범위를 올리는 것이 곧 적절해질 것으로 예상한다"고 되어 있다. 당장의 1월 기준 금리는 현재의 0.00∼0.25%가 유지된다.

다음은 연준 FOMC 정책 성명

Indicators of economic activity and employment have continued to strengthen. The sectors most adversely affected by the pandemic have improved in recent months but are being affected by the recent sharp rise in COVID-19 cases. Job gains have been solid in recent months, and the unemployment rate has declined substantially. Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy continues to depend on the course of the virus. Progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation. Risks to the economic outlook remain, including from new variants of the virus.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent. With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate. The Committee decided to continue to reduce the monthly pace of its net asset purchases, bringing them to an end in early March. Beginning in February, the Committee will increase its holdings of Treasury securities by at least $20 billion per month and of agency mortgage‑backed securities by at least $10 billion per month. The Federal Reserve's ongoing purchases and holdings of securities will continue to foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; James Bullard; Esther L. George; Patrick Harker; Loretta J. Mester; and Christopher J. Waller. Patrick Harker voted as an alternate member at this meeting.

Implementation Note issued January 26, 2022

Last Update: January 26, 2022

김대호 글로벌이코노믹 연구소장 tiger8280@g-enews.com

[알림] 본 기사는 투자판단의 참고용이며, 이를 근거로 한 투자손실에 대한 책임은 없습니다.

![[뉴욕증시 주간전망] 추수감사절 연휴 속 PCE 물가지수에 촉각...FOMC 의사록 공개](https://nimage.g-enews.com/phpwas/restmb_setimgmake.php?w=184&h=118&m=1&simg=2024112405524409582c35228d2f5175193150103.jpg)