이미지 확대보기

이미지 확대보기신용평가에서 긍정적이라는 평가는 현재의 등급에서 조만간 좀 더 높은 등급으로 상향조정하겠다는 의미이다.

이에 반해 안정적이란 평가는 현재의 등급을 당분간 그대로 고수하겠다는 뜻이다.

무디스는 9일 인도 국가신용등급 'Baa3'에 대한 전망을 '안정적'에서 '긍정적'으로 변경한다고 공식발표했다.

무디스가 안정적에서 긍정적으로 등급전망을 바꿈에 따라 인도의 국가신용등급은 'Baa3'에서 그보다 높은 'Baa2' 또는 'Baa1'등으로 상향조정될 것으로 보인다. 이는 인도경제 사상 가장 높은 등급이다

등급이 'Baa2' 또는 'Baa1'로 오르면 인도의 채권이 그만큼 쉬워진다. 채권을 발행할 때 적용하는 금리도 싸진다.

비단 채권 뿐만 아니라 외국 자본의 유입이 늘어나 주식시장과 기업활동에도 도움을 받을 것으로 기대된다.

국제통화기금(IMF)은 최근 세계의 각 국별 경제전망에서 인도를 가장 모범적인 나라로 지목한 바 있다.

성장률 면에서는 이미 중국을 앞질렀다.

이번 등급조정은 인도의 외자조달을 더욱 손쉽게 만들어 인도경제의 성장세를 더욱 가속화시킬 것으로 기대된다.

무디스는 등급조정의 배경으로 인도의 정책당국이 최근 취한 일련의 조치들이 경제성장의 결실을 가져올 가능성이 높다는 점을 들었다.

(Moody's decision to revise the ratings outlook to positive from stable is based on its view that there is an increasing probability that actions by policy makers will enhance the country's economic strength and, in turn, the sovereign's financial strength over coming years.)

또 같은 Baa3 등급에 속해있는 나라 중에서 인도가 지난 10년간 저축과 투자증가 등으로 가장 높은 성장률을 기록해온 사실도 이번 등급조정의 한 요인이 됐다고 무디스는 덧붙였다.

(India has grown faster than similarly rated peers over the last decade due to favorable demographics, economic diversity, as well as high savings and investment rates.)

무디스는 이어 국제상품가격의 변동과 유동성 상황의 변화도 인도경제에 도움이 되고 있다고 평가했다.

(Moody's expects these structural advantages, supported by relatively benign global commodity prices and liquidity conditions, will keep India's growth higher than that of its peers over the rating horizon.)

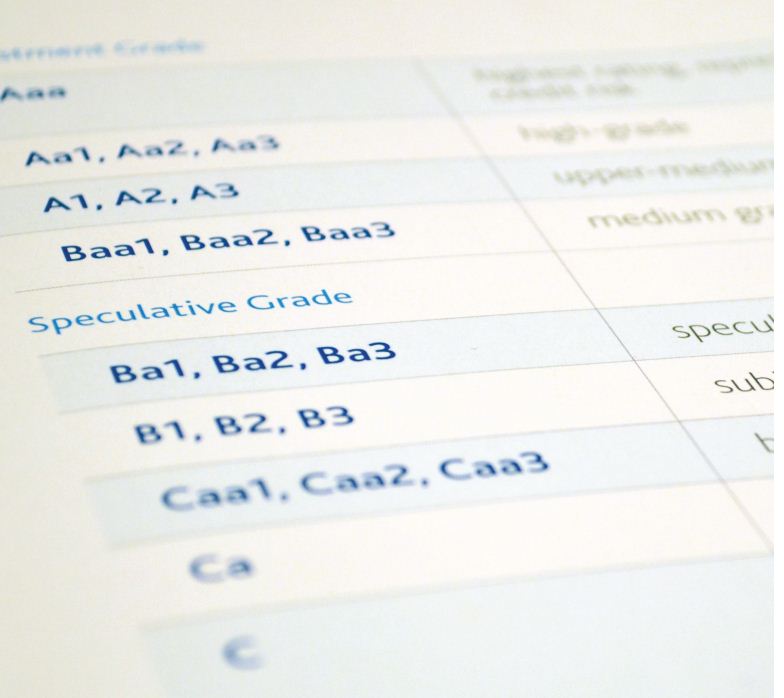

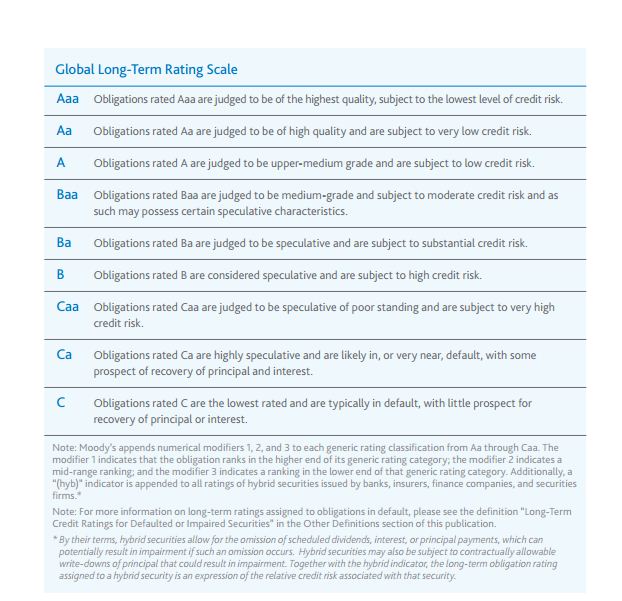

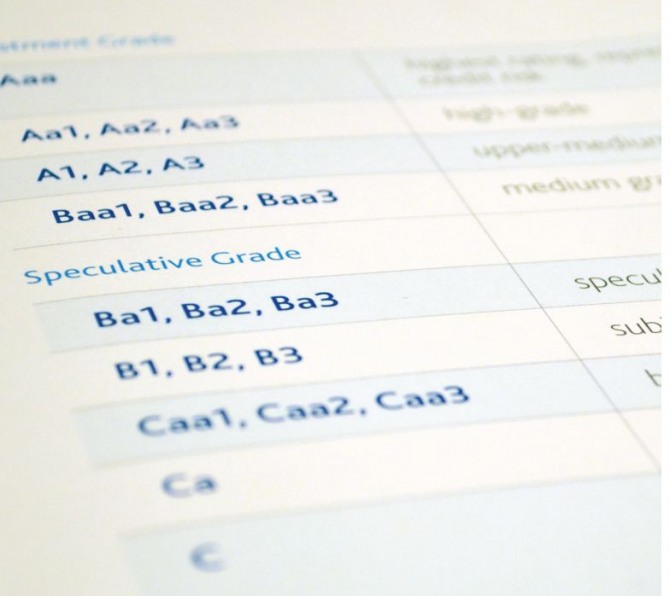

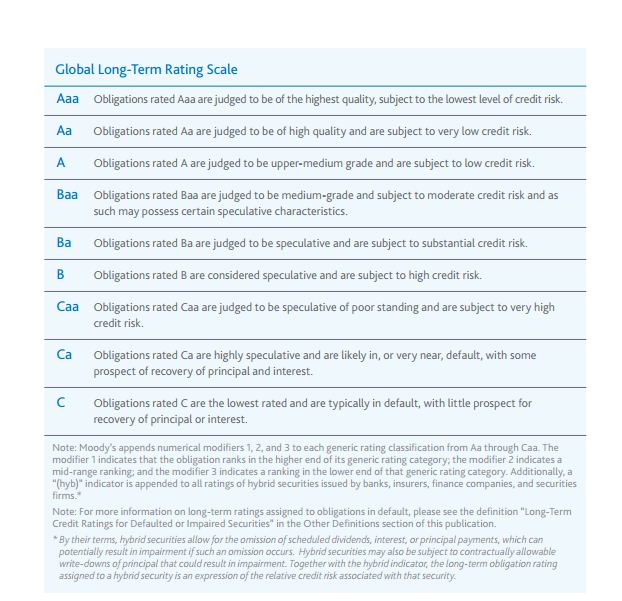

Baa3는 무디스가 분류하고 있는 '투자 적격' 등급 가운데 가장 낮은 등급이다.

[무디스 발표문 전문]

Moody's Investors Service has today affirmed the Government of India's Baa3 issuer and senior unsecured ratings and changed the rating outlook to positive from stable.

Moody's has also affirmed India's P-3 short-term local currency issuer rating.Moody's decision to revise the ratings outlook to positive from stable is based on its view that there is an increasing probability that actions by policy makers will enhance the country's economic strength and, in turn, the sovereign's financial strength over coming years.

India has grown faster than similarly rated peers over the last decade due to favorable demographics, economic diversity, as well as high savings and investment rates.

Moody's expects these structural advantages, supported by relatively benign global commodity prices and liquidity conditions, will keep India's growth higher than that of its peers over the rating horizon.

However, recurrent inflationary pressures, occasional balance of payments pressures, and an uncertain regulatory environment have contributed to periods of volatility in growth, and have exposed India to external and financial shocks, constraining its credit profile.

Moody's believes that recent measures to address inflation, keep external balances in check, simplify the regulatory regime for investors, increase foreign direct investment, and facilitate infrastructure development will reduce some of India's sovereign credit constraints.

Many of these measures are at relatively early stages of design and have yet to be implemented. According to Moody's, the ability of policymakers to strengthen India's sovereign credit profile to a level consistent with a higher rating will become apparent over the next 12-18 months.

India's Baa3 government bond rating incorporates credit strengths, such as its diversified economy, robust growth prospects, relatively high domestic savings rate and high international reserve buffers.

It also reflects India's weaker performance -- relative to peers -- on fiscal, inflation and infrastructure-related metrics. And while policies are beginning to address each of these factors, the extent of likely improvements is as yet unclear.

Moreover, India's banking system's asset quality, loan loss coverage and capital ratios are relatively weak. This poses sovereign credit risks because of the banking sector's role in financing growth as well the government's deficits through its purchase of government securities, and the contingent liabilities due to the government's ownership of a major portion of the banking sector. In the absence of any improvement in banking-system metrics over the coming months, India's sovereign credit profile will remain constrained.

The Baa3 rating incorporates the risk that higher levels of growth and infrastructure development will be accompanied by higher leverage. Sovereign credit improvements over the next 12-18 months will depend on the extent to which growth, policies and buffers can contain the risks associated with rising leverage.

Evidence over the coming months that policymakers are likely to be successful in their efforts to introduce growth-enhancing and growth-stabilizing economic and institutional reforms would lead to the rating being considered for an upgrade.

On the other hand, the rating outlook would be revised to stable if economic, fiscal and institutional strengthening appeared unlikely, or banking system metrics remained weak or balance of payments risks rose.

The Baa2/P-2 country ceiling for foreign currency debt and Baa3/P-3 country ceiling for foreign currency bank deposits remain unchanged. The A1 local currency country ceiling and bank deposit ceiling remain unchanged.

이미지 확대보기

이미지 확대보기GDP per capita (PPP basis, US$): 5,777 (2014) (also known as Per Capita Income)

Real GDP growth (% change): 7.4% (FY 2014/15E) (also known as GDP Growth)

Inflation Rate (CPI, % change ): 4.3% (December 2014 Actual)

Gen. Gov. Financial Balance/GDP: -6.9% (FY 2014/15) (also known as Fiscal Balance)

Current Account Balance/GDP: -1.1% (FY2014/15) (also known as External Balance)

External debt/GDP: 22.8% (FY 2014/15)

Level of economic development: High level of economic resilience

Default history: No default events (on bonds or loans) have been recorded since 1983.

On 07 April 2015, a rating committee was called to discuss the rating of the India, Government of. The main points raised during the discussion were: The issuer's economic fundamentals, including its economic strength, have materially increased. The issuer's institutional strength/framework, have materially increased. The issuer's fiscal or financial strength, including its debt profile, has not materially changed.

김대호 경제연구소 소장 tiger8280@