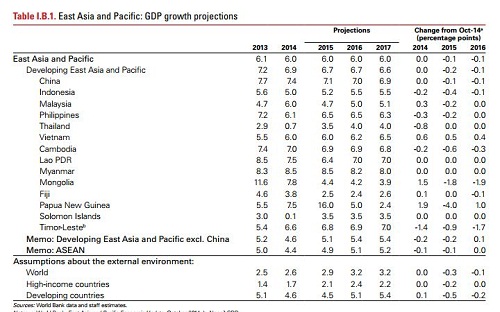

세계은행이 13일 공표한 '동아시아 태평양 경제현황 보고서'에 따르면 인도네시아, 말레이시아, 필리핀, 태국, 베트남, 캄보디아, 라오스, 미얀마, 피지, 파푸아뉴기니, 살로몬제도, 티모르등 아시아 태평양 지역의 13개 신흥국의 올해 국내총생산(GDP)성장률은 평균 5.1%에 달할 것으로 전망됐다.

세계은행은 경제성장률이 높아지는 가장 큰 이유로 유가하락을 꼽았다.

유가하락이 일부 지역에서는 재앙이지만 원유생산비중이 낮은 아시아 태평양지역에서는 경제에 상당한 플러스요인으로 작용하고 있다고 분석했다.

또 전 세계적인 수요증가도 이 지역 경제에 도움이 되고 있다고 세계은행은 덧붙였다.

세계은행은 그러나 이 13개국에 중국을 합할 경우에는 평균성장률이 2014년의 6.9%에서 올해는 6.7%로 0.2%포인트 떨어질 것이라고 내다봤다.

이지역에서 가장 덩치가 큰 중국의 성장률이 2014년 4.5%에서 올해 7.1%로 하락할 것으로 전망된 데 따른 것이다.

성장률 4.5%보다 높은 수준이다. 아시아 지역이 다른 지역보다 경제성장의 속도가 더 빠른 것이다.

국별로는 파푸아뉴기니가 16.0%로 성장률 전망치가 가장 높았다. 그 다음은 미얀마로 8.5%, 중국 7.1% 등의 순이다.

[다음은 세계은행의 아시아 태평양경제 보고서 발표문 전문]

Economic growth will ease slightly in developing countries in East Asia and Pacific this year, even as the region benefits from lower oil prices and a continued economic recovery in developed economies, according to the East Asia Pacific Economic Update released today by the World Bank.

The developing economies of East Asia are projected to grow by 6.7% in 2015 and 2016, slightly down from 6.9% in 2014. China’s growth is expected to moderate to around 7% in the next two years compared with 7.4% in 2014. Growth in the rest of developing East Asia is expected to rise by half a percentage point, to 5.1% this year, largely driven by domestic demand—thanks to upbeat consumer sentiment and falling oil prices—in the large Southeast Asian economies. Several smaller economies, especially commodity exporters such as Mongolia, will see lower growth.

“Despite slightly slower growth in East Asia, the region will still account for one-third of global growth, twice the combined contribution of all other developing regions,” said Axel van Trotsenburg, World Bank East Asia and Pacific Regional Vice President. “Lower oil prices will boost domestic demand in most countries in the region and provide policy makers a unique opportunity to push fiscal reforms that will raise revenues and reorient public spending toward infrastructure and other productive uses. These reforms can improve East Asia’s competitiveness and help the region retain its status as the world’s economic growth engine.”

Low global oil prices will benefit most developing countries in East Asia, especially Cambodia, Laos, the Philippines, Thailand, and the Pacific island countries. But the region’s net fuel exporters, including Malaysia and Papua New Guinea, will see slower growth and lower government revenues. In Indonesia, the net impact on growth will depend on how much a decline there will be for its coal and gas exports.

The headwinds facing the world economy continue to pose risks to East Asia’s globally-integrated economies. The recovery in high-income countries continues to be slow and uneven, and a downturn in the eurozone and Japan would weaken global trade. Higher U.S. interest rates and an appreciating U.S. dollar, along with diverging monetary policy paths across advanced economies, could raise borrowing costs, generate financial volatility and reduce capital flows to East Asia. The continued strengthening of the U.S. dollar against other major currencies also could hurt highly-dollarized economies such as Cambodia and Timor-Leste.

“East Asia Pacific has thrived despite an unsteady global recovery from the financial crisis, but many risks remain for the region, both in the short and long run,” said Sudhir Shetty, Chief Economist of the World Bank’s East Asia and Pacific Region. “To address these risks, improving fiscal policy is key. With low oil prices, countries – whether oil importers or exporters – should reform energy pricing to usher in fiscal policies that are more sustainable and equitable.”

In most of the larger East Asian economies, efforts to bolster revenues and restructure spending can help fill the gap in infrastructure investments and create more funding for social protection and insurance programs, which are already under pressure amid rapid aging in the region, the report says. In the major fuel exporting countries and Mongolia, fiscal consolidation is required.

Lower oil prices, in particular, create an opportunity for governments to reduce fuel subsidies and raise energy taxes, the report says. Across much of the region, fuel subsidies and related tax expenditures have strained public finances and weakened current accounts. Some countries, including Indonesia and Malaysia, recently took steps to cut fuel subsidies, but Shetty said the momentum needs to be sustained and broadened, even if oil prices begin to recover.

In China, as it shifts to a consumption-led, rather than an investment-led, growth model, the main challenge is to implement reforms that will ensure sustainable growth in the long run. Policies to spur growth, the report says, should support restructuring efforts.

In the medium term, the report says, countries should expand and upgrade physical infrastructure and improve public access to higher education and health care. In the long term, countries will need to find ways to sustain productivity growth, contain health care costs and expand the revenue base for social security.

The East Asia and Pacific Update is the World Bank’s comprehensive review of the region’s economies.

김대호 경제연구소 소장 tiger8280@

![[초점] 퇴보하는 ‘이민자의 나라’…美 반이민 정서 확산](https://nimage.g-enews.com/phpwas/restmb_setimgmake.php?w=184&h=118&m=1&simg=20240426105827034139a1f3094311109215171.jpg)

![[속보] 美 3월 근원 PCE 물가, 전년比 2.8% 증가...시장 예상치 ...](https://nimage.g-enews.com/phpwas/restmb_setimgmake.php?w=80&h=60&m=1&simg=20240426212148010594a01bf698f12113517828.jpg)