이미지 확대보기

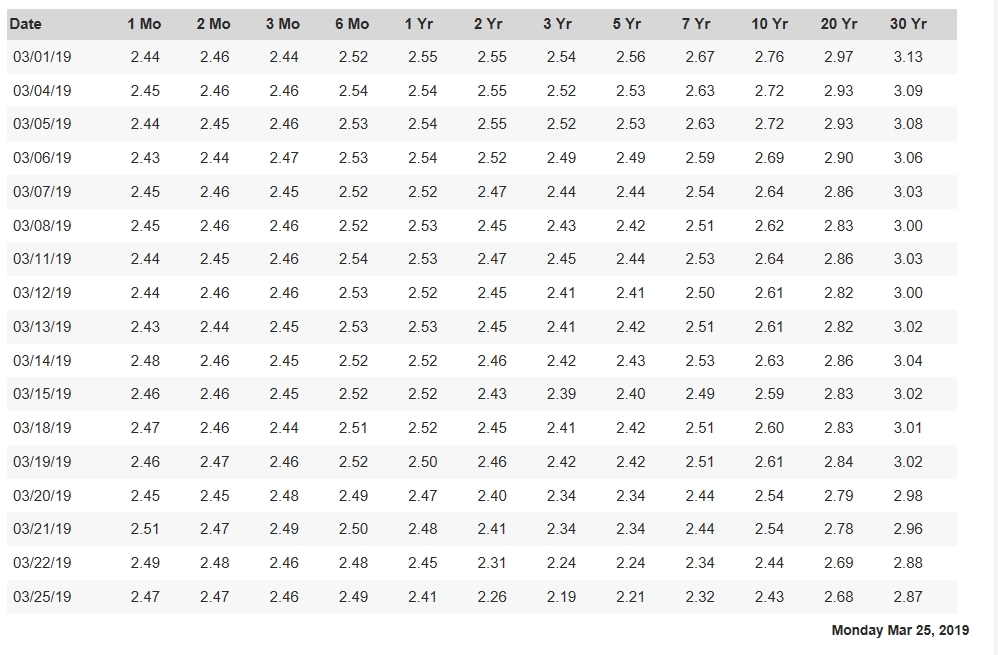

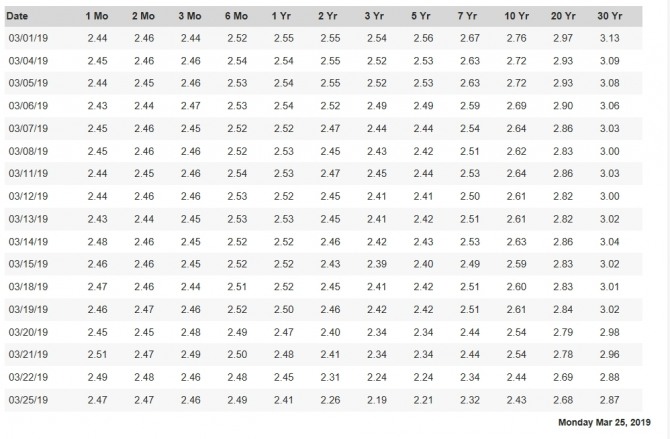

이미지 확대보기26일 미국 뉴욕증시에 따르면 3년짜리 국채 수익률을 이날 2.1% 수준으로 떨어졌다.

10년짜리 수익률이 3년짜리 보다 더 높아지면서 미국 뉴욕증시와 한국 증시 코스닥 코스피 등을 압박해왔던 채권 장단기 금리 역전 현상이 극복됐다.

미국 뉴욕증시에서는 장단기 금리 역전 현상이 생기면서 글로벌 경제에 대한 침체 우려가 생겨났다.

이른바 R의 공포가 닥친 것이다.

장단기 금리 역전 현상이 해소되면서 글로벌 경제에 대한 침체 우려가 크게 줄었다.

R의 공포가 사라지면서 미국 뉴욕증시 다우지수 나스닥지수 S&P 500 지수는 막판에 올랐다.

코스피 코스닥 원달러환율 국제유가 국제금값도 새로운 변화의 모멘텀을 맞고 있다.

Monday Mar 25, 2019

3년 국채 2,19% < 10년 국채 2.43%

| 03/25/19 | 2.47 | 2.47 | 2.46 | 2.49 | 2.41 | 2.26 | 2.19 | 2.21 | 2.32 | 2.43 | 2.68 | 2.87 |

* The 2-month constant maturity series begins on October 16, 2018, with the first auction of the 8-week Treasury bill.

30-year Treasury constant maturity series was discontinued on February 18, 2002 and reintroduced on February 9, 2006. From February 18, 2002 to February 8, 2006, Treasury published alternatives to a 30-year rate. See Long-Term Average Rate for more information.

Treasury discontinued the 20-year constant maturity series at the end of calendar year 1986 and reinstated that series on October 1, 1993. As a result, there are no 20-year rates available for the time period January 1, 1987 through September 30, 1993.

Treasury Yield Curve Rates: These rates are commonly referred to as "Constant Maturity Treasury" rates, or CMTs. Yields are interpolated by the Treasury from the daily yield curve. This curve, which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the over-the-counter market. These market yields are calculated from composites of indicative, bid-side market quotations (not actual transactions) obtained by the Federal Reserve Bank of New York at or near 3:30 PM each trading day. The CMT yield values are read from the yield curve at fixed maturities, currently 1, 2, 3 and 6 months and 1, 2, 3, 5, 7, 10, 20, and 30 years. This method provides a yield for a 10 year maturity, for example, even if no outstanding security has exactly 10 years remaining to maturity.

Monday Mar 25, 2019

* The 2-month constant maturity series begins on October 16, 2018, with the first auction of the 8-week Treasury bill.

30-year Treasury constant maturity series was discontinued on February 18, 2002 and reintroduced on February 9, 2006. From February 18, 2002 to February 8, 2006, Treasury published alternatives to a 30-year rate. See Long-Term Average Rate for more information.

Treasury discontinued the 20-year constant maturity series at the end of calendar year 1986 and reinstated that series on October 1, 1993. As a result, there are no 20-year rates available for the time period January 1, 1987 through September 30, 1993.

Treasury Yield Curve Rates: These rates are commonly referred to as "Constant Maturity Treasury" rates, or CMTs. Yields are interpolated by the Treasury from the daily yield curve. This curve, which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the over-the-counter market. These market yields are calculated from composites of indicative, bid-side market quotations (not actual transactions) obtained by the Federal Reserve Bank of New York at or near 3:30 PM each trading day. The CMT yield values are read from the yield curve at fixed maturities, currently 1, 2, 3 and 6 months and 1, 2, 3, 5, 7, 10, 20, and 30 years. This method provides a yield for a 10 year maturity, for example, even if no outstanding security has exactly 10 years remaining to maturity.

김대호 주필/ 경제학 박사 tiger8280@g-enews.com